Report of the Directors

1 The Industrial Digitalisation revenue growth is on comparable basis by excluding the Internet Finance revenue for 2021 of E-surfing Pay Co., Ltd. (which was disposed in April 2021).

1. DISCUSSION AND ANALYSIS OF OPERATIONS

In 2022, the further advancement in the building of Digital China as well as the thriving development of digital economy brought new development opportunities to the industry. The Company implemented the new development principles completely, accurately and comprehensively based on the new development stage, while taking the initiative to serve and integrate into the new development pattern. The Company resolutely fulfilled its responsibilities in building Cyberpower and Digital China as well as safeguarding network and information security and fully implemented its Cloudification and Digital Transformation strategy. The Company further advanced the deployment of capabilities led by sci-tech innovation and leveraged deepened reforms to propel the unleashing of development momentum continuously. The Company’s corporate governance system has been further optimised. The Company spared no effort in developing a service-oriented, technology-oriented and secured enterprise, while sharing the new achievements of its high-quality development with shareholders, customers and society.

1. Overall results

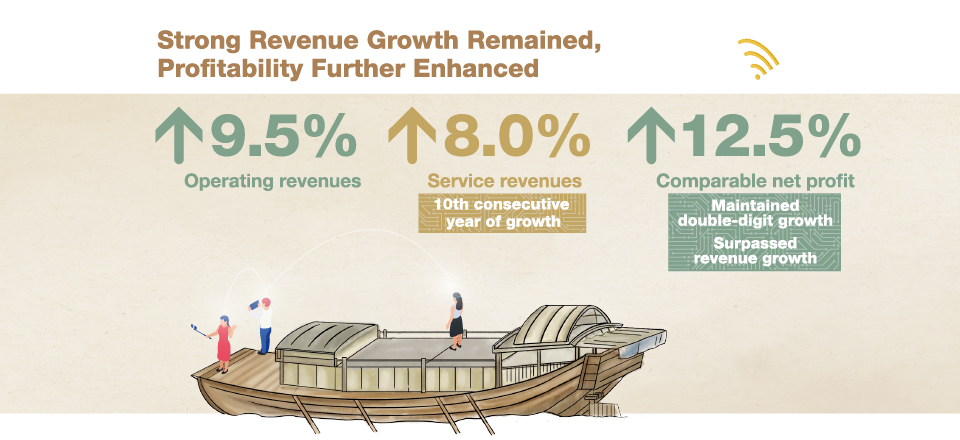

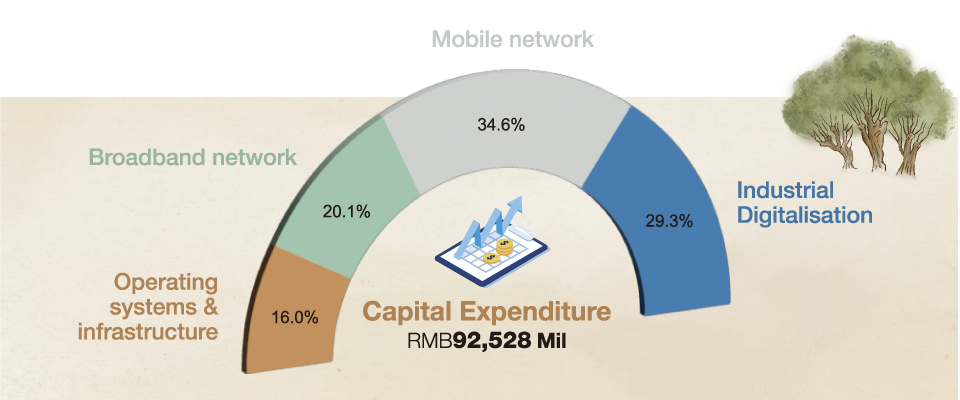

In 2022, the Company’s operating revenues amounted to RMB481.4 billion, representing an increase of 9.5% year-on-year. Service revenues2 amounted to RMB434.9 billion, representing an increase of 8.0% year-on-year. Excluding the revenue impact from the disposals of its subsidiaries in 20213, the year-on-year growth rate reached 8.1%. EBITDA4 amounted to RMB130.4 billion, representing an increase of 5.2% year-on-year. Net profit5 amounted to RMB27.6 billion, representing an increase of 6.3% year-on-year. Excluding the one-off after-tax gain from the disposals of its subsidiaries in 20216, the year-on-year growth rate reached 12.5%. The basic earnings per share were RMB0.30. Capital expenditure was RMB92.5 billion and free cash flow7 reached RMB13.2 billion.

2 Service revenues are calculated based on operating revenues minus sales of mobile terminals, sales of wireline equipment and other non-service revenues. Of which, mobile service revenues amounted to RMB206.9 billion, representing an increase of 6.0% year-on-year; wireline service revenues amounted to RMB228.0 billion, representing an increase of 9.8% year-on-year.

3 Service revenues for 2021 excluded Internet Finance revenue prior to the disposal of E-surfing Pay Co., Ltd. which was completed in April 2021.

4 EBITDA is calculated based on operating revenues minus operating expenses plus depreciation and amortisation.

5 Net profit represents profit attributable to equity holders of the Company.

6 The one-off after-tax gain from the disposals of E-surfing Pay Co., Ltd. and China Telecom Leasing Corporation Limited was approximately RMB1,416 million.

7 Free cash flow is calculated based on EBITDA minus capital expenditure, income tax and depreciation charge for right-of-use assets other than land-use-rights.

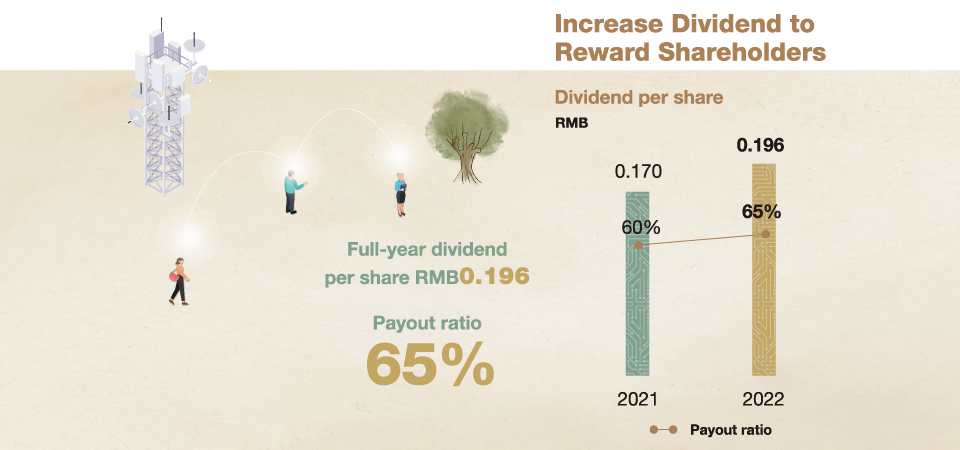

The Company attaches great importance to shareholder returns and strives to enhance its profitability and cash flow generation capabilities, while effectively controlling capital expenditure. Taking the Company’s profitability into full consideration, alongside cash flow levels and capital needs for its future development, the Board of Directors has decided to recommend at the Annual General Meeting that a final dividend of 2022 of RMB0.076 per share (pre-tax) shall be declared. Together with the 2022 interim dividend of RMB0.120 per share (pre-tax) which has been distributed, the full year dividend of 2022 amounts to RMB0.196 per share (pre-tax), and the aggregate amount of the full year dividend represents 65% of the profit attributable to equity holders of the Company for the year. Within the three years following the Company’s A Share Offering and Listing, the profit to be distributed in cash for each year will gradually increase to 70% or above of the profit attributable to equity holders of the Company for that year, continuously creating more value to all shareholders.

2. Fully implementing cloudification and digital transformation strategy, while taking high-quality corporate development to a new level

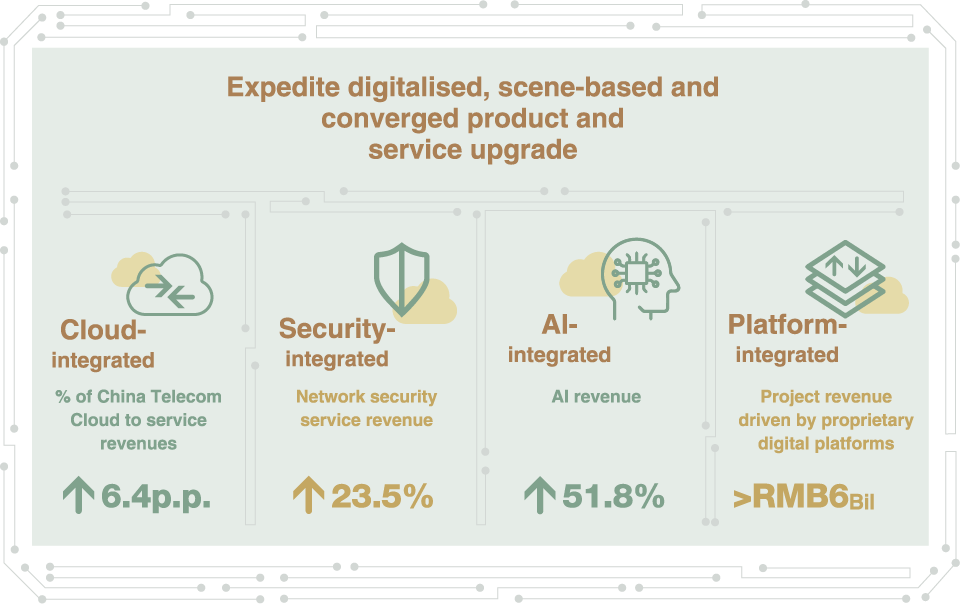

In 2022, the Company comprehensively implemented its Cloudification and Digital Transformation strategy, and fully completed its deployment in the fields of businesses, capabilities, sci-tech innovation, cloud-network and reforms. The Company built new development momentum through cloud-, AI-, security- and platform-integrated initiatives and further enhanced its digital supply capabilities. The Company strived to develop an enterprise with “three orientations”8 while further advancing its high-quality development.

8 Enterprise with “three orientations”: service-oriented, technology-oriented and secured enterprise.

2.1 Further upgrade of integrated intelligent information products and services, with adherence to the customer-oriented approach

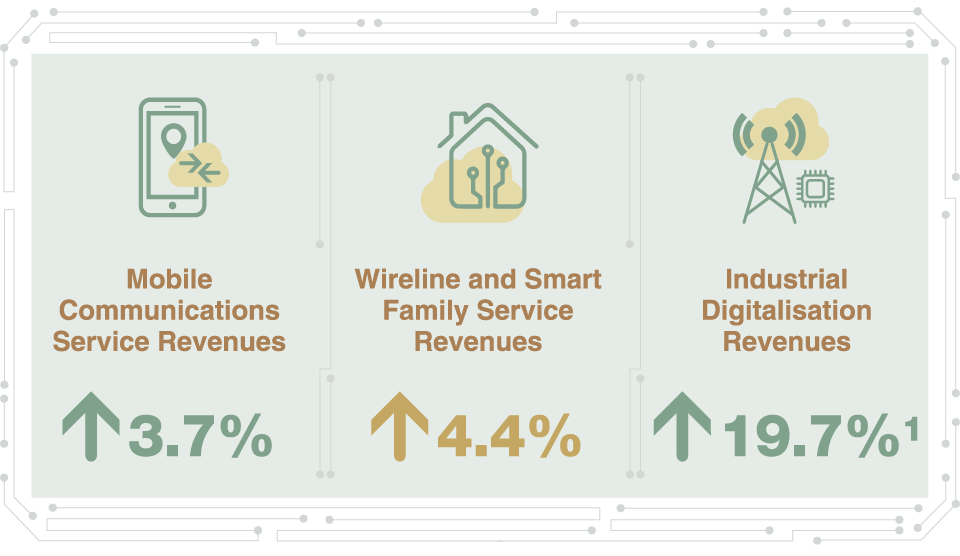

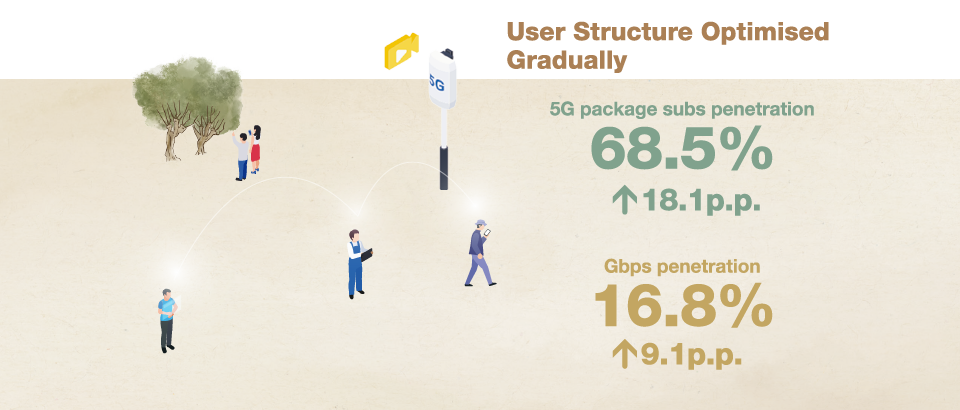

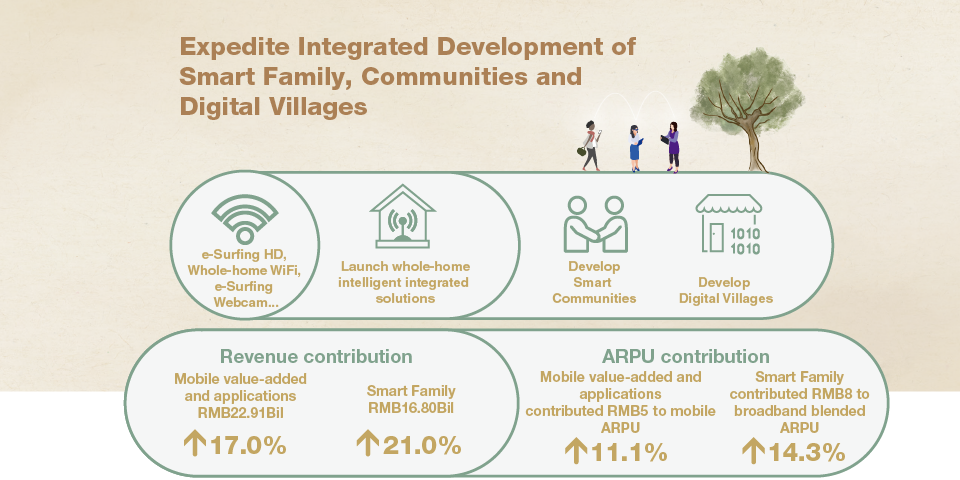

The Company further accelerated the transformation of its fundamental businesses, strengthened the promotion of digital products supply, and proactively expanded the new path featuring integrated development of Smart Family, Digital Village and Smart Community, enabling the whole society to enjoy a better digital life while promoting the steady growth of its fundamental businesses. The Company continued to strengthen its 5G network coverage, optimise network quality and enhance 5G user experience to promote mobile subscribers growth and value stabilisation. Leveraging the convergence of “5G + Gigabit broadband + Gigabit WiFi”, as well as the incorporation of digital elements such as AI, security, cloud, the Company promoted the application expansion and service upgrade of broadband subscribers. With the creation of an open and integrated digital life platform, the Company provided communities and villages with leading capabilities in connecting households, communities and government, as well as abundant solutions for grassroots governance. The Company also provided integrated scene-based applications such as Video Door Access Control, Community Management and Village Governance. In 2022, the Company’s mobile communications service revenues amounted to RMB191.0 billion, representing an increase of 3.7% year-on-year, maintaining favourable growth. The penetration rate of 5G package subscribers reached 68.5%. The value contributions from mobile value-added services and applications continued to grow, with mobile ARPU9 reaching RMB45.2, representing an increase of 0.4% year-on-year. Wireline and Smart Family service revenues amounted to RMB118.5 billion, representing an increase of 4.4% year-on-year. The penetration rate of Gigabit broadband reached 16.8%. The number of Whole-home WiFi and e-Surfing Webcam subscribers increased by 45.8% and 52.7% respectively. The value contributions from Smart Family service continued to grow. Broadband blended ARPU10 reached RMB46.3, representing an increase of 0.9% year-on-year. The Company’s overall customer satisfaction maintained an industry-leading position.

9 Mobile ARPU = monthly average revenues from mobile services/the average number of mobile subscribers.

10 Broadband blended ARPU = monthly average revenues from broadband access, e-Surfing HD and Smart Family applications and services/the average number of broadband subscribers.

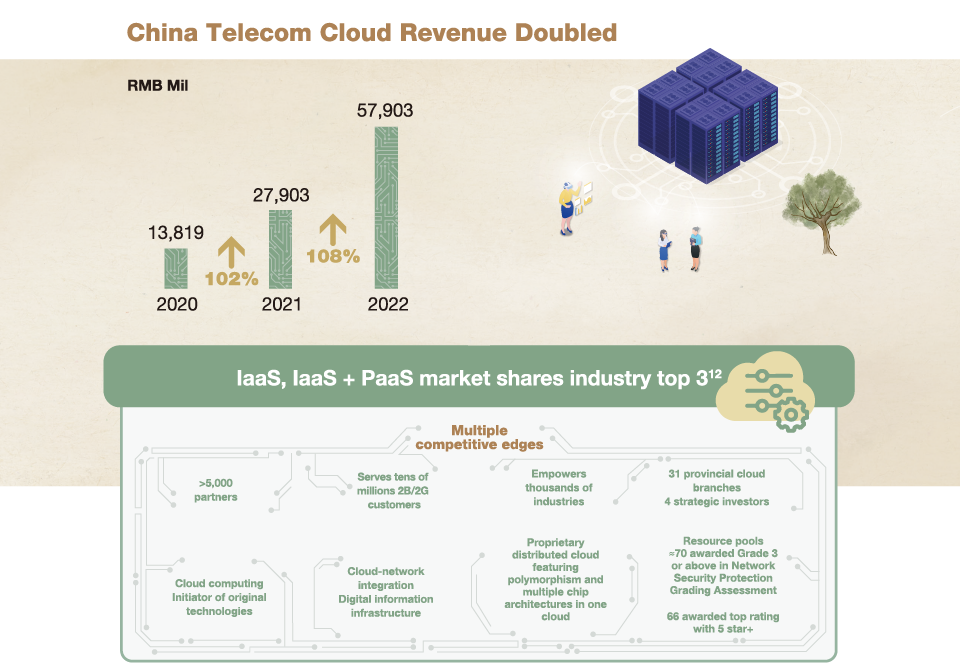

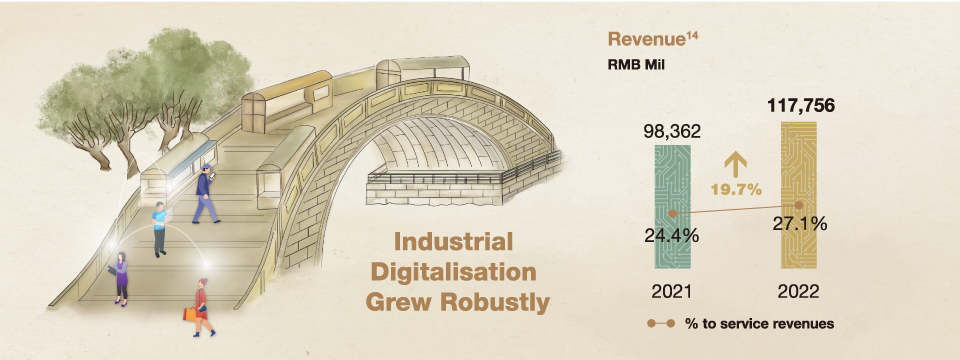

The Company proactively seized the current opportunities brought by the demands from various industries in the economy and society for network-based, digitalised, and smart integrated information services and created a model for Industrial Digitalisation development that deeply integrates “cloud-network capability foundation + industry application platforms”, providing digital integrated solutions for numerous walks of life. China Telecom Cloud has entered into a stage of 4.0 with full commercialisation after more than ten years of development. The market share of China Telecom Cloud continued to increase, becoming the world’s largest carrier cloud and China’s largest hybrid cloud. It has grown to rank among the top-three in China’s public cloud IaaS market and public cloud IaaS+PaaS market, while maintaining its No.1 position in the dedicated cloud market in terms of market share. The Company supported the digital transformation of the national economy and society, achieving remarkable results in scale expansion in key areas of national economy and people’s livelihood. Focusing on 5G industry use cases, the cumulative number of 5G 2B commercial projects developed by the Company reached approximately 15,000, of which the number of newly added projects in 2022 exceeded 8,000. This fully unleashed new momentum of transformation for vertical industries. Meanwhile, emerging businesses, such as network security, Big Data, AI and digitalised platform, have gradually become new drivers for Industrial Digitalisation development. In 2022, revenue from Industrial Digitalisation of the Company amounted to RMB117.8 billion, representing a year-on-year growth of 19.7% on a comparable basis11. Revenue from China Telecom Cloud reached RMB57.9 billion, representing an increase of 107.5% year-on-year. Revenue from network security services amounted to RMB4.7 billion, representing an increase of 23.5% year-on-year.

11 Revenue for Industrial Digitalisation in 2021 has excluded the Internet Finance revenue before the disposal of E-surfing Pay Co., Ltd..

Chairman Ke Ruiwen presented at World 5G Convention

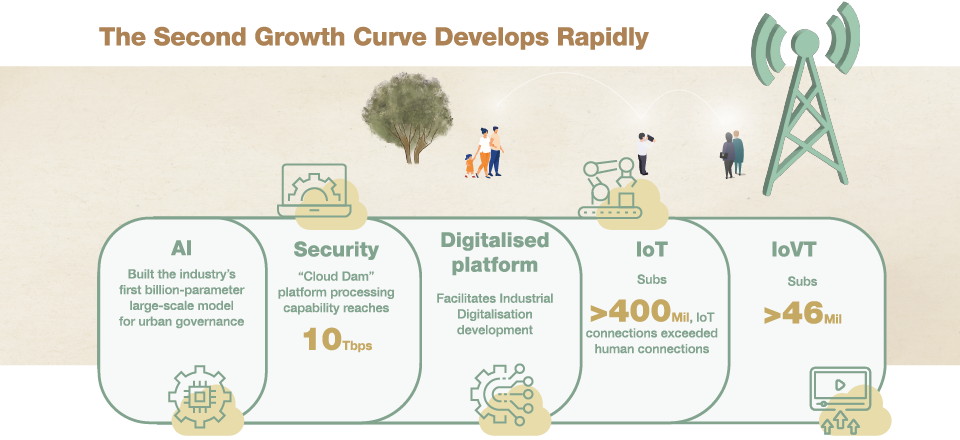

2.2 Seizing opportunities arising from the development of digital economy and bolstering the momentum of the second growth curve

The Company further deepened the forward-looking deployment of digital technologies to lay a solid foundation for the innovation and development of digital economy. The Company also built new development momentum through cloud-, AI-, security- and platform-integrated initiatives, and further advanced capability deployment of various emerging businesses. The Company promoted the rapid development of the second growth curve to empower the high-quality development of digital economy. The Company completed the upgrade to China Telecom Cloud 4.0 which is a distributed cloud with wide-area coverage, featuring the integration of “cloud, network, edge, terminal, data, intelligence and security” as a whole. A number of its proprietary core technologies in fundamental software and hardware of cloud computing, such as TeleCloudOS4.0 cloud operating system, CTyunOS server operating system, TeleDB database and Zijin DPU were fully launched and achieved scale commercialisation of products. This further consolidated the independent and controllable cloud foundation featuring polymorphism and multiple chip architectures in one cloud. The Company strengthened proprietary research and development (R&D) of AI core capabilities, built the industry’s first billion-parameter large-scale model for urban governance and promoted the expansion of large-scale models towards model hubs at the industry level. The Company strengthened the end-to-end supply of security products and services, completed the construction of “Cloud Dam” platform with full network coverage as well as a processing capacity of 10Tbps. The Company built an integrated security infrastructure platform, “Security Brain”, for industry customers. The Company accelerated the building of proprietary digital platform capabilities, and built the unified industry digitalised platform foundation. The Company enhanced the efficiency and quality of proprietary platform development, and promoted the development of Industry Digitalisation business. The number of Internet of Things (IoT) subscribers exceeded 400 million, achieving “IoT connections exceeding human connections”. e-Surfing Internet of Video Things (IoVT) achieved rapid development, with its number of subscribers exceeding 46 million. Use cases such as Kitchen Monitoring, Security Smart Eye, Smart Enterprise and e-Surfing Emergency Response achieved scale commercialisation.

12 Source of market share data: IDC Quarterly Public Cloud Services Tracker, 2022Q3.

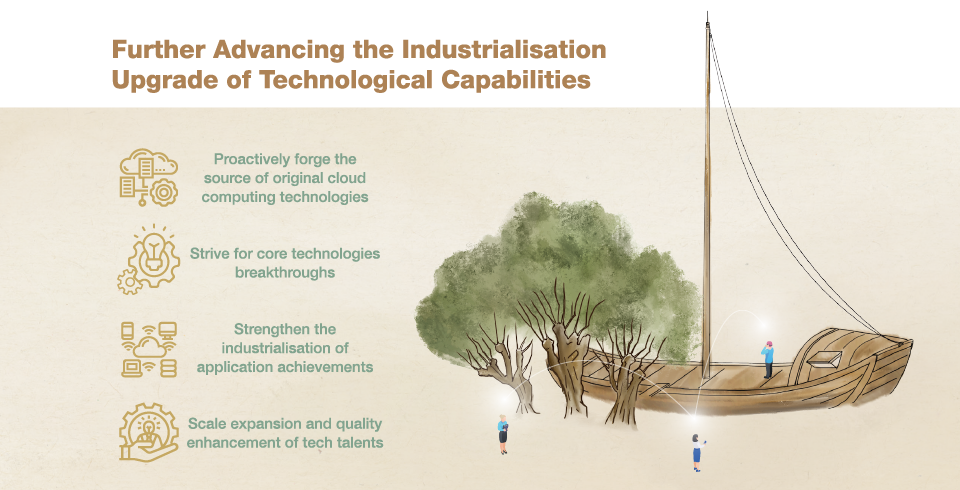

2.3 Insisting on the leading role of sci-tech innovation while further advancing the industrialisation upgrade of technological capabilities

Adhering to “science and technology constitute a primary productive force”, the Company strove to develop a technology-oriented enterprise. The Company was credited with the honorary title of “Enterprise with Outstanding Contribution to Sci-tech Innovation” by the State-owned Assets Supervision and Administration Commission (SASAC). The Company fully completed the deployment of its R&D system for sci-tech innovation, RDO13, and proactively explored a development path featuring productisation of technological capabilities and industrialisation of innovative achievements. The Company built a platform for high-level sci-tech innovation, strengthened the fundamental support for R&D, and proactively forged the source of original cloud computing technologies while undertaking the construction of innovation platforms such as cloud-network infrastructure. The Company established joint sci-tech research institutions with key laboratories, renowned universities and sci-tech research institutes for cutting-edge technologies such as 6G and next-generation network. The Company further strove for core technologies breakthroughs, with significant enhancement of capabilities in R&D of cloud-network technologies. The Company’s achieved breakthroughs in key technologies of cloud computing such as software and hardware integration, operating system as well as database. The Company’s computing power channelling of cloud storage and etc. has reached an advanced level within the industry. The computing power distribution network platform of China Telecom Cloud 4.0, “XiRang”, was successfully selected as one of the “2022 Top 10 Super Projects of Central Enterprises”. The Company also built China’s largest quantum metropolitan network, the “Hefei Quantum Metropolitan Network”. The Company further strengthened the industrialisation of application achievements, realising the application of AI large-scale models under a number of scenes such as digital life and smart manufacturing. The Company also rolled out scale commercialisation of products such as Security Brain, Cloud Computer and CDN. Domestic invention patents and PCT patent applications were 1.4 times and 2 times, respectively, of the same period of last year. The Company achieved scale expansion and quality enhancement of its tech talents, with the introduction of leading talents in areas of cloud computing, AI and Big Data, among others. The number of chief experts being newly recruited or renewed exceeded 10. The Company also innovated its talent development mechanism and introduced a chief technician system, along with honouring awards for tech talents and the promotion of special talent pool systems, altogether creating a conducive ecology for innovation.

13 RDO: fundamental research (R), applied technological research and development (D) and operational development (O).

14 The Industrial Digitalisation revenue and % to service revenues in 2021 as well as growth rate in 2022 are on comparable basis by excluding the Internet Finance revenue for 2021 of E-surfing Pay Co., Ltd. (which was disposed in April 2021).

Chairman Ke Ruiwen introduced China Telecom’s measures in promoting cloud-network integration and co-building the age of computing power

2.4 Expediting the promotion of cloud-network integration to consolidate the foundation of digital information infrastructure

The Company comprehensively advanced the overall planning and coordinated deployment of various digital elements such as “cloud, network, data, intelligence and security”. The Company also accelerated the transformation and upgrades of networks as well as the construction of intelligent integrated digital information infrastructure that is high-speed and ubiquitous, aerial-ground in one, cloud-network integrated, intelligent and agile, green and low-carbon, as well as secure and controllable. The Company further optimised the “2 + 4 + 31 + X + O” layout of its computing power and built proprietary multiple availability zones (AZs) capabilities of China Telecom Cloud 4.0 in central nodes of regions of Beijing-Tianjin-Hebei, Yangtze River Delta, Guangdong-Hong Kong-Macau Greater Bay Area and Chengdu-Chongqing. The number of cities covered by “One-City-One-Pool” exceeded 240, while the number of edge computing power nodes surpassing 800, providing customers with highly-efficient and efficiently-centralised distributed cloud service with ultra-low latency. In 2022, the newly added computing power of China Telecom Cloud was 1.7 EFLOPS, with its total computing power reaching 3.8 EFLOPS, representing an increase of 81% year-on-year. The Company built the four-level AI computing power comprising of “entire network-region-edge-terminal” with nationwide coverage. The Company also built an efficiently-centralised core platform for AI capabilities, achieving unified channelling of AI computing power, algorithms and data while aggregating more than 5,000 algorithms and over 100 scene-based solutions. The Company proactively responded to the national strategy of “East-to-West Computing Resource Transfer” and stepped up deployment with a focus on 8 hub nodes. The Company currently owns more than 700 IDC sites and over 3,000 edge DC, and the number of IDC cabinets amounted to 513,000 with a utilisation rate of over 70%. The Company has the greatest number and the most extensive distribution of IDC resources in China. Surrounding national datacentres, the Company built interconnection networks for datacentres with large bandwidth, high reliability, wide coverage and multiple layers. The latency between AZs was below 1ms. The Company built the largest Gigabit fibre network in scale, with the number of 10G PON ports exceeding 6.30 million, covering over 250 million family users in the Company’s service region. The Company achieved interconnection between the mobile network and the satellite network and realised multiple functions for one single card. The Company continued to give full play to its role in safeguarding network and information security, formed security infrastructure capabilities covering cloud, network, edge and terminal, and completed the construction of “Cloud Dam” platform with full network coverage. The Company’s security capability pools covered more than 150 cities. The Company’s new-generation cloud-network operating system was fully launched, realising the integrated management of cloud, network and security as well as the automatic activation of the whole business process for cloud-network integration. The Company fully promoted the green and low-carbon transformation of cloud-network infrastructure, and adopted measures such as customised high-performance servers to enhance computing efficiency. The Company also applied various new energy-saving technologies to enhance the energy efficiency of datacentres and telecommunications equipment rooms, and sped up the energy-saving application of AI technologies to mobile base stations and old equipment rooms, with a power saving of over 600 million kWh per year. The Company and China Unicom further promoted 4G/5G co-building and co-sharing. The cumulative number of 5G base stations co-built and co-shared by the two parties exceeded one million while the number of co-shared 4G stations exceeding 1.1 million. The co-building and co-sharing achieved remarkable results. The cumulative investment savings in network construction for both parties amounted to over RMB270 billion, while the annualised savings of operating costs exceeded RMB30 billion, contributing key technologies in co-building and co-sharing as well as operation and management experiences to the global communications industry.

- Customers experiencing VR game application

- Customers shopping for Smart Family products

2.5. Continuing to unlock reform momentum to significantly bolster corporate development vitality

With the satisfaction of customers’ digitalisation demands as the core and the enhancement of corporate core competitiveness as the target, the Company comprehensively promoted the reform of corporate organisations, processes, and market-oriented operation mechanisms. The Company continued to deepen its enterprise service reform, solidly advanced the development of industrial research institute, cloud core platform, as well as local integration teams to establish a cloud-centric main business process and a highly efficient operating system. The Company stepped up its efforts and accelerated the reform of professional companies, making substantial progress in diversifying the equity ownership of its cloud company. It also achieved corporate operation of Big Data and AI centre, rapidly enhancing its level of market-orientation. The Company’s cloud, security and IoT companies were shortlisted by SASAC in its list of “Sci-tech Reform Demonstration Enterprises”, with its core competitiveness in sci-tech innovation continuing to strengthen. The Company fully leveraged its massive data resources to build a distributed Big Data lake and develop a Big Data storage and processing model with cloud-edge coordination. While empowering the digital transformation of its customers, the Company also accelerated its internal digital transformation of products, sales, service, operation and management to continuously promote costs reduction and efficiency enhancement, while further uplifting its operating efficiency. With in-depth implementation of market-oriented operation mechanisms, the Company fully implemented a tenure system and contractual management at the managerial level. It also launched the “Talent Nurturing Programme” for the first time, while vigorously implementing incentive measures for talents such as special talent pools, expert incentives, equity and bonus sharing based on job positions. This continued to enhance employee vitality. The Company established a 4-in-1 integration system of “market insight, budget, assessment and incentive”, with steady enhancement of the development as well as the value creation capability of various business units.

Management introduced the strong development momentum of China Telecom Cloud

Adhering to the cooperation philosophy of “Broadest Scope, Best Service, Best Value, Farthest Growth”, the Company carried out greater, broader and deeper ecological cooperation with its partners. The Company signed strategic cooperation agreements with governments of various provinces and cities to comprehensively support governments’ informatisation construction. The Company expanded the informatisation service for the government affairs market, strengthened ecological cooperation with industry leaders, and opened up the digital platform of fundamental capabilities. The Company aggregated proprietary capabilities as well as capabilities from ecological cooperation to provide customers with integrated “cloud-network + data-intelligence” solutions. The Company continuously expanded 5G Industry Innovation Alliance to explore 5G innovative applications and build 5G industry ecology. The number of member units exceeded 400. The Company commenced extensive cooperation with partners from four areas including technology, application, channel and service. The Company created a cloud computing community and fully opened up to co-build the national cloud ecology. The Company also carried out in-depth cooperation with leading vendors to push forward the construction of a security capability pool that effectively aggregates capabilities of various parties, while creating an open security ecology. By vigorous promotion of industry and research cooperation in the field of AI with domestically well-known universities and sci-tech research institutions, the Company spared no effort to jointly build an innovation ecology of AI industry. The Company conducted deployment in the capital ecology with a focus on key areas, and promoted coordinated development with companies within the capital ecology to give full play to the multiplier effect of capital investment and bring new momentum for the Company’s value growth.

Management introduced the Company’s achievements of innovations in cloud-network core capabilities

Successfully completed various major communications assurance tasks

3. Undertook Social Responsibilities While Optimising Corporate Governance

The Company proactively fulfilled its social responsibilities, successfully completed communications assurance tasks for important scenes and spared no effort to establish network “lifelines” during times of natural disasters. The Company also proactively promoted green cloud-network construction and operation. In 2022, through co-building and co-sharing and various energy saving measures, the Company reduced its greenhouse gas emissions by more than 13 million tons, while greenhouse gas emissions per unit of information flow decreased by 20.6% year-on-year. It built the country’s first “zero-carbon datacentre” in Qinghai. The Company served rural revitalisation, promoted universal service and bridged the digital divide. The Company also proactively participated in social welfare, and provided informatised products for Covid-19 Epidemic (“Epidemic”) prevention such as e-Surfing Cloud Broadcasting, Cloud Conference, Cloud Computer, Cloud SaaS applications and Display of Caller Name Card, among others. The Company leveraged digital means to support sci-tech based Epidemic prevention and assisted small and medium-sized enterprises (SMEs) to overcome challenges. The Company strengthened employee care and promoted the mutual development of both employees and the Company.

Insisting on high-standard corporate governance while adhering to excellent, prudent and effective corporate governance principles, the Company continued to optimise its corporate governance system, standardise its corporate operations, strengthen its internal control system and implement refined governance and disclosure measures. In addition to the compliance and efficient operation of its Shareholders Meeting, Board of Directors and Supervisory Committee, the Company fully achieved the establishment of Board of Directors on various levels of its subsidiaries where appropriate. The Company further realised lean management and stable operation. The Company continued to optimise its internal control and comprehensive risk management to effectively ensure stable operation of the Company. The level of its corporate governance continued to strengthen to effectively protect the best and long-term interests of its shareholders.

In 2022, the Company received high affirmation and recognition from domestic and international capital markets and industry organisations. Of which, the Company was voted as the “Most Honoured Companies in Asia” for the 12th consecutive year by Institutional Investor. The Company also ranked No.1 in categories such as “Best Investor Relations”, “Best IR Team” and “Best Overall ESG”. In addition, the Company received a number of awarded such as “Asia’s Best Corporate Social Responsibility”, “Best Corporate Communications”, “Best Environmental Responsibility” and “Best Investor Relations Company” in the “Asian Excellence Award 2022” organised by Corporate Governance Asia, a renowned journal on corporate governance in Asia. Moreover, the Company was voted as “Most Outstanding Company in China – Telecommunication Services Sector” in Asiamoney’s “Asia’s Outstanding Companies Poll 2022”. The Company was further awarded with the “Overall Most Outstanding Company in China” among all winners from different sectors in China. At the same time, the Company was also awarded with “Best Practice of Office of Board of Directors for Public Companies in 2022” as well as “Best Practice Award of 2021 Annual Results Briefing for Public Companies” by China Association for Public Companies.

4. OUTLOOK

The building of Digital China is an important driver for the advancement of Chinese modernisation in the digital era. The Company will firmly seize the valuable strategic development opportunities, proactively fulfill its responsibility in building Digital China and insist on seeking progress while maintaining stability. With high-quality development as the theme, digital transformation as the main line, reform, opening and innovation as the driving force, the Company will comprehensively and deeply implement the Cloudification and Digital Transformation strategy while further striving for breakthroughs in key core technologies of digitalisation. The Company will create the supply of digital products with a focus on customer demands, and strive to build a digital service platform that is open and co-shared. The Company will also speed up the construction of the digital information infrastructure, stimulate the potential of data elements and proactively promote reforms of organisations and mechanisms that are adaptable to digital transformation. The Company will tangibly enhance its core competitiveness and accelerate the building of a world-class enterprise.

Ke Ruiwen

Chairman and Chief Executive Officer

Beijing, China

22 March 2023

2. OVERVIEW OF THE COMPANY’S INDUSTRY DURING THE REPORTING PERIOD

1. Industry Overview

In 2022, the communications industry comprehensively promoted the implementation of the “14th Five-Year Plan”. The revenue of telecommunications business maintained its relatively rapid growth momentum, showing the development characteristics of positive trends, optimised structure and enhanced momentum. The Company appropriately advanced the deployment of 5G, Gigabit and other new infrastructure construction and continuously enhanced the supporting role of digital development. The quality enhancement and upgrade of information service supply continued to inject new digital momentum into the economic development.

In 2022, China’s telecommunications service revenue accumulated to RMB1.58 trillion, representing an increase of 8.0% over the previous year. The business structure was further optimised, and the role of emerging businesses in driving revenue growth continued to strengthen. Emerging digital services, which mainly include datacentres, cloud computing, Big Data, IoT, etc., developed rapidly, contributing 64.2% to the revenue growth of telecommunications services. The traditional businesses, which mainly include mobile data traffic, broadband access, voice and SMS, still played the stabiliser role, accounting for 66.8% of the revenue from telecommunications services.

In 2022, the investment in the industry maintained growth. The total investment in fixed assets in the telecommunications industry amounted to RMB419.3 billion, and the investment in 5G exceeded RMB180.3 billion. The wireline network has gradually leaped from 100Mbps to Gigabit, and the number of 10G PON ports with Gigabit service capabilities exceeded 15 million. Mobile network maintained a global leading position in terms of 5G construction. China has built and activated 2,312,000 5G base stations. The fundamental telecommunications enterprises stepped up their efforts in the construction of their own computing power. The net addition of cabinets in self-used datacentres was 160,000 for the year. They also strove to build service capabilities with the integration of network, connectivity, computing power, data and security, laying the foundation for providing high-quality new digital services.

In 2022, there were continuous achievements of integrated applications from fields such as smart manufacturing, smart healthcare, smart education, digital government administration and others. The number of “5G + Industrial Internet” projects invested and constructed nationwide exceeded 4,000, creating a batch of full 5G-connected factories and providing over 14,000 5G virtual private networks. The whole industry successfully completed major communications service assurance tasks such as the Beijing Winter Olympics, carried out special actions in the Internet industry and strengthened app governance, continuously enhanced the support capability of Big Data in communications, and further uplifted the service level.

Note: The above data are from MIIT’s Statistical Communique of the Communications Industry in 2022.

2. Significant impact of new laws, administrative regulations, departmental rules and industry policies on the industry

During the Reporting Period, a number of laws and departmental rules were promulgated and implemented, introducing new requirements for the development and compliance operation of the industry.

On 24 June 2022, the Standing Committee of the National People’s Congress considered and approved the Decision to Amend the Anti-monopoly Law of the People’s Republic of China, which came into effect on 1 August 2022. According to the amended Anti-monopoly Law of the People’s Republic of China (the “Anti-monopoly Law”), operators shall not use data and algorithms, technologies, capital advantages and platform rules to engage in monopolistic activities prohibited by the Anti-monopoly Law; they shall not organise other operators to enter into monopoly agreements or provide substantive assistance for other operators to enter into monopoly agreements; operators with dominant market positions shall not engage in actions that abuse their dominant market positions through the use of data and algorithm, technologies and platform rules.

On 7 July 2022, the Cyberspace Administration of China published the Measures for the Security Assessment of Outbound Data Transfer, which came into effect on 1 September 2022. The Measures for the Security Assessment of Outbound Data Transfer specify: the circumstances under which data processors shall report the security assessment of outbound data transfer and the procedures for the security assessment of outbound data transfer; data processors shall conduct self-assessment of outbound data transfer risks before reporting the security assessment of outbound data transfer; and the legal documents entered into with overseas receivers shall clearly stipulate the responsibilities for data security protection.

On 2 September 2022, the Standing Committee of the National People’s Congress considered and approved the Law of the People’s Republic of China on Anti-Telecom and Online Fraud (the “Anti-Telecom and Online Fraud Law”), which came into effect on 1 December 2022. According to the Anti-Telecom and Online Fraud Law, telecommunications business operators shall fully implement the real identity information registration system for telephone users in accordance with the law, standardise the transmission of real call numbers and the lease of telecommunications lines, and block, intercept and trace phone calls made with changed numbers; no excessive telephone cards shall be processed; no support or assistance shall be provided to others for the execution of telecom and online fraud activities; technical measures shall be taken to timely identify and block illegal equipment and software access to the network, and report to the public security authorities and relevant industry authorities.

On 8 December 2022, the Ministry of Industry and Information Technology issued the Administrative Measures for Data Security in the Field of Industry and Information Technology (for Trial Implementation) (the “Administrative Measures for Data Security (Trial)”), which came into effect on 1 January 2023. According to the Administrative Measures for Data Security (Trial), data processors in the industry and information technology field shall regularly sort out the data and file the catalogues of important data and core data of their units with the regional industry regulatory authorities; a lifecycle data security management system should be established; data security risk monitoring should be carried out, potential safety hazards should be identified in a timely manner, and necessary measures should be taken to prevent data security risks.

The Company will conscientiously implement the relevant newly issued and revised laws, administrative regulations, departmental rules and industry policies, and proactively follow and study the relevant upcoming laws, administrative regulations, departmental rules and industry policies to ensure that the relevant business operations are in compliance with laws and regulations and that the Company operates in compliance with laws and regulations.

Management presented at Cloud Ecology Conference

3. BUSINESS OF THE COMPANY DURING THE REPORTING PERIOD

In 2022, the Company proactively integrated into the overall situation of digital economy construction, fully implemented the development strategy of “Cloudification and Digital Transformation”, and focused on building a service-oriented, technology-oriented and secured enterprise, elevating its high-quality development to a new level.

The Company seized opportunities arising from the development of digital economy, continued to accelerate the transformation of fundamental businesses, strengthened the supply of digital products, and promoted the steady growth of fundamental businesses. The Company continuously enhanced 5G network coverage and network quality, upgraded 5G-featured applications, strengthened the incorporation of new differentiated elements such as AI, security and cloud, to promote subscriber growth and value stabilisation. Leveraging the convergence of “5G + Gigabit Broadband + Gigabit WiFi”, the Company continued to accelerate the upgrade of broadband speed, enriched the supply of scene-based applications for households, and proactively expanded the new development path featuring integrated development of Smart Family, Digital Village and Smart Community. In 2022, the Company’s mobile subscribers reached 391 million, representing a net increase of 18.75 million. 5G package subscribers reached 268 million, with its penetration rate reaching 68.5%, representing a year-on-year increase of 18.1 percentage points. Mobile ARPU reached RMB45.2, representing a year-on-year increase of 0.4%. Broadband subscribers reached 181 million, representing a net increase of 11.19 million. The penetration rate of Gigabit subscribers reached 16.8%, representing a year-on-year increase of 9.1 percentage points. Broadband blended ARPU reached RMB46.3, representing a year-on-year increase of 0.9%.

The Company firmly grasped the demand for network-based, digitalised, and smart integrated information services in the era of digital economy, created a model for Industrial Digitalisation development that deeply integrates “cloud-network capability foundation + industry application platforms”, providing digital integrated solutions for numerous walks of life. Insisting on the driving force from cloud-, AI-, security- and platform-integrated initiatives, the Company further advanced the capability deployment of emerging businesses, boosted the rapid development of the second growth curve, and empowered the high-quality development of digital economy. China Telecom Cloud has entered into a stage of 4.0 with full commercialisation, with continuous increase in market share. The number of 5G 2B commercial projects increased rapidly, fully unleashing new momentum of transformation for vertical industries. Emerging businesses, such as network security, Big Data, AI and digitalised platform, have gradually become new drivers for Industrial Digitalisation development. In 2022, revenue from Industrial Digitalisation of the Company amounted to RMB117.8 billion, representing a year-on-year growth of 19.7% on a comparable basis. Revenue from China Telecom Cloud reached RMB57.9 billion, representing an increase of 107.5% year-on-year. Revenue from network security services amounted to RMB4.7 billion, representing an increase of 23.5% year-on-year.

For detailed business analysis of the Company, please refer to “5. MAJOR OPERATION DURING THE REPORTING PERIOD” in this section.

4. ANALYSIS OF CORE COMPETITIVENESS DURING THE REPORTING PERIOD

In 2022, China Telecom fully implemented its “Cloudification and Digital Transformation” strategy, and achieved new results in high-quality development.

Continuous optimisation of business deployment, with Industrial Digitalisation and China Telecom Cloud becoming important drivers for revenue growth

The Company continued to optimise its business deployment, and Industrial Digitalisation and China Telecom Cloud have become important drivers for revenue growth. By creating a model for Industrial Digitalisation development that deeply integrates “cloud-network capability foundation + industry application platforms”, the Company provided digital integrated solutions for numerous walks of life. China Telecom Cloud has entered into a stage of 4.0 with full commercialisation after more than ten years of development. The market share of China Telecom Cloud continued to increase, becoming the world’s largest carrier cloud and China’s largest hybrid cloud. It has grown to rank among the top-three in China’s public cloud IaaS market and public cloud IaaS+PaaS market, while maintaining its No.1 position in the dedicated cloud market in terms of market share. Focusing on 5G industry use cases, the cumulative number of 5G 2B commercial projects developed by the Company reached approximately 15,000, of which the number of newly added projects in 2022 exceeded 8,000. This fully unleashed new momentum of transformation for vertical industries. Meanwhile, emerging businesses, such as network security, Big Data, AI and digitalised platform, have gradually become new drivers for Industrial Digitalisation development.

Rapid replication of 5G smart agriculture projects

Further advancement of capability deployment and rapid growth of new momentum for market development

The Company’s further advanced its capability deployment, built new development momentum through cloud-, AI-, security- and platform-integrated initiatives, and boosted the rapid development of the second growth curve. The Company completed the upgrade to China Telecom Cloud 4.0 which is a distributed cloud with wide-area coverage, featuring the integration of “cloud, network, edge, terminal, data, intelligence and security” as a whole. A number of its proprietary core technologies in fundamental software and hardware of cloud computing, such as TeleCloudOS4.0 cloud operating system, CTyunOS server operating system, TeleDB database and Zijin DPU were fully launched and achieved scale commercialisation of products. This further consolidated the independent and controllable cloud foundation featuring polymorphism and multiple chip architectures in one cloud. The Company strengthened proprietary R&D of AI core capabilities, built the industry’s first billion-parameter large-scale model for urban governance and promoted the expansion of large-scale models towards model hubs at the industry level. The Company strengthened the end-to-end supply of security products and services, completed the construction of “Cloud Dam” platform with full network coverage as well as a processing capacity of 10Tbps. The Company built an integrated security infrastructure platform, “Security Brain”, for industry customers. The Company accelerated the building of proprietary digital platform capabilities, and built the unified industry digitalised platform foundation. The Company enhanced the efficiency and quality of proprietary platform development, and promoted the development of Industry Digitalisation business. The number of IoT subscribers exceeded 400 million, achieving “IoT connections exceeding human connections”. e-Surfing IoVT achieved rapid development, with its number of subscribers exceeding 46 million. Use cases such as Kitchen Monitoring, Security Smart Eye, Smart Enterprise and e-Surfing Emergency Response achieved scale commercialisation.

Constant deepening of the reform deployment and significant enhancement of employees’ vitality

With the satisfaction of customers’ digitalisation demands as the core and the enhancement of corporate core competitiveness as the target, the Company comprehensively promoted the reform of corporate organisations, processes, and market-oriented operation mechanisms. The Company continued to deepen its enterprise service reform, solidly advanced the development of industrial research institute, cloud core platform, as well as local integration teams to establish a cloud-centric main business process and a highly efficient operating system. The Company stepped up its efforts and accelerated the reform of professional companies, making substantial progress in diversifying the equity ownership of its cloud company. It also achieved corporate operation of Big Data and AI centre, rapidly enhancing its level of market-orientation. The Company’s three subsidiaries were shortlisted by SASAC in its list of “Sci-tech Reform Demonstration Enterprises”, with its core competitiveness in sci-tech innovation continuing to strengthen. The Company also accelerated its internal digital transformation of products, sales, service, operation and management to continuously promote costs reduction and efficiency enhancement, while further uplifting its operating efficiency. With in-depth implementation of market-oriented operation mechanisms, the Company fully implemented a tenure system and contractual management at the managerial level. It also launched the “Talent Nurturing Programme” for the first time, while vigorously implementing incentive measures for talents such as special talent pools, expert incentives, equity and bonus sharing based on job positions. This continued to enhance employee vitality. The Company established a 4-in-1 integration system of “market insight, budget, assessment and incentive”, with steady enhancement of the development as well as the value creation capability of various business units.

Solid promotion of cloud-network deployment and continuous enhancement of operation capability

The Company accelerated the construction of digital information infrastructure with cloud-network integration as the core feature. The Company further optimised the “2 + 4 + 31 + X + O” layout of its computing power and built proprietary multiple AZs capabilities of China Telecom Cloud 4.0. The number of cities covered by “One-City-One-Pool” exceeded 240. In 2022, the total computing power of China Telecom Cloud reached 3.8 EFLOPS. The Company built the four-level AI computing power comprising of “entire network-region-edge-terminal” with nationwide coverage. The Company also built an efficiently-centralised core platform for AI capabilities. The Company proactively responded to the national strategy of “East-to-West Computing Resource Transfer”. The Company has the greatest number and the most extensive distribution of IDC resources in China. Surrounding national datacentres, the Company built interconnection networks for datacentres with large bandwidth, high reliability, wide coverage and multiple layers. The Company built the largest Gigabit fibre network in scale, with the number of 10G PON ports exceeding 6.30 million. The Company achieved interconnection between the mobile network and the satellite network. The Company completed the construction of “Cloud Dam” platform with full network coverage. The Company’s security capability pools covered more than 150 cities. The Company’s new-generation cloud-network operating system was fully launched, realising the integrated management of cloud, network and security as well as the automatic activation of the whole business process for cloud-network integration. The Company fully promoted the green and low-carbon transformation of cloud-network infrastructure. The Company sped up the energy-saving application of AI technologies to mobile base stations and old equipment rooms, with a power saving of over 600 million kWh per year. The Company and China Unicom further promoted 4G/5G co-building and co-sharing. The cumulative number of 5G base stations co-built and co-shared by the two parties exceeded one million while the number of co-shared 4G stations exceeding 1.1 million. The cumulative investment savings in network construction for both parties amounted to over RMB270 billion.

Adhering to the people-oriented development philosophy and continuously strengthening service capabilities

The Company adhered to the people-oriented and problem-oriented principles, regarded customer perception as the starting point and foothold of all work, and comprehensively enhanced service quality. The Company strengthened the new supply of digital products, proactively promoted the digitalisation of production methods, lifestyle and social governance, and strove to meet the new digital needs of customers. The Company deepened the service mechanism of “customers have the final say”, promoted the construction of a “customer-centric” production and operation organisation, established long-term mechanisms such as service review, service red flags, supervision and accountability, and quickly resolved the difficult and hot issues that customers were concerned about. Customer satisfaction has reached the best level in recent years, while the service quality of networks, products and channels continuing to strengthen and customer reputation continuing to become more positive.

Insisting on self-reliance and self-improvement of high-level technologies, while achieving breakthroughs in sci-tech innovation

Adhering to “science and technology constitute a primary productive force”, the Company strove to develop as a technology-oriented enterprise and was credited with the honorary title of “Enterprise with Outstanding Contribution to Sci-tech Innovation”. The Company fully completed the deployment of its R&D system for sci-tech innovation, RDO. The Company built a platform for high-level sci-tech innovation, strengthened the fundamental support for R&D, and proactively forged the source of original cloud computing technologies while undertaking the construction of innovation platforms such as cloud-network infrastructure. The Company established joint sci-tech research institutions with key laboratories, renowned universities and sci-tech research institutes for cutting-edge technologies. The Company further strove for core technologies breakthroughs, achieving breakthroughs in key technologies of cloud computing such as software and hardware integration. The Company’s computing power channelling of cloud storage and etc. has reached an advanced level within the industry. The computing power distribution network platform of China Telecom Cloud 4.0, “XiRang”, was successfully selected as one of the “2022 Top 10 Super Projects of Central Enterprises”. The Company also built China’s largest quantum metropolitan network, the “Hefei Quantum Metropolitan Network”. The Company further strengthened the industrialisation of application achievements, realising the application of AI large-scale models under a number of scenes such as digital life and smart manufacturing. The Company also rolled out scale commercialisation of products such as Security Brain, Cloud Computer and CDN. Domestic invention patents and PCT patent applications were 1.4 times and 2 times, respectively, of the same period of last year. The Company achieved scale expansion and quality enhancement of its tech talents. The Company also innovated its talent development mechanism, altogether creating a conducive ecology for innovation.

Adhering to the overall national security concept and steadily enhancing security capabilities

The Company gave play to its role as the fundamental assurance in the field of network and information security, and accelerated the improvement in supply of security products and services supply. Focusing on the industrial chain, innovation chain and supply chain, the Company stepped up its expansion efforts, aggregated open and integrated core capabilities, and gradually optimised its security-oriented corporate strategy. The Company established a security technologies system, enhanced the security operation system and accountability system with strengthened security talents, and continuously optimised the deployment of security work. The Company established a big security products system to continuously enhance the capabilities of network security, cloud security, data security and public security products. The Company continued to enhance the effectiveness of security governance, with its AI + anti-fraud technology capabilities becoming significantly strengthened.

5. MAJOR OPERATION DURING THE REPORTING PERIOD

The Company proactively integrated into the overall situation of digital economy construction, deeply implemented the customer-centric operation principles, and continued to enhance digital products and services supply capabilities for various customer groups such as individuals, households, governments and enterprises. The Company strove to build a service-oriented, technology-oriented and secured enterprise, elevating its high-quality development to a new level. In 2022, the Company’s operating revenues amounted to RMB481.4 billion, representing an increase of 9.5% year-on-year. Of which, service revenues amounted to RMB434.9 billion, representing an increase of 8.0% year-on-year. Excluding the revenue impact from the disposals of its subsidiaries in 2021, the year-on-year growth rate reached 8.1%, maintaining favourable growth.

Continuous enhancement of 5G network coverage and quality

Further accelerating the upgrade of 5G network and applications, and enriching digital products supply, achieving steady growth as well as scale and quality enhancement of mobile business

The Company deeply explored customer needs and application scenes in the digital era, continued to upgrade integrated intelligent information products and services by leveraging the further strengthened 5G cloud-network capabilities, and continuously promoted the steady development of its mobile business. The Company continued to strengthen 5G network coverage and network quality to provide users with a “more secure, more reliable and more intelligent” mobile communications experience. The Company continued to upgrade 5G-featured applications, constantly optimised large bandwidth applications such as 5G Ultra HD, 5G Cloud VR/AR and 5G Cloud Games, and accelerated the promotion of new applications such as 5G Messaging and 5G New Calls to meet the diversified application demands of customers. The Company continued to strengthen the incorporation of new differentiated elements such as AI, security and cloud, and launched AI-integrated products such as AI Communications Assistant and AI Colour Ringback Tone with Video for individual customers. The Company also rolled out security-integrated products such as Quantum-encrypted Calls and e-Surfing Anti-Harassment, as well as cloud-integrated products such as China Telecom Cloud Mobile Phone and Cloud Drive, so as to further enhance the high-quality supply capabilities in the field of information consumption. The Company continued to build the digitalised platforms, constantly responded to changes in customer consumption habits and the needs for quality upgrade in the digital era. Focusing on various consumption scenes such as people’s livelihood payment, catering and travel, the Company enriched the new model of mobile digital consumption, and drove the continuous enhancement of both scale and value of mobile subscribers.

In 2022, the Company’s mobile communications service revenues amounted to RMB191.0 billion, representing an increase of 3.7% year-on-year, maintaining favourable growth. Mobile subscribers reached 391 million, representing a net addition of 18.75 million. 5G package subscribers reached 268 million, representing a penetration rate of 68.5% and a year-on-year increase of 18.1 percentage points. Mobile ARPU reached RMB45.2, representing a year-on-year increase of 0.4%.

Management introduced new measures to enhance customer service

Further accelerating the service upgrade and integrated development of Smart Family, Smart Community and Digital Village, with steady growth of broadband blended ARPU and constant enhancement of the value of Smart Family business

The Company seized opportunities arising from the development of the digital economy, and continued to meet the needs of the whole society to enjoy a better digital life by leveraging the comprehensive advantages of continuously upgraded and optimised networks, applications, services and platforms. The Company continued to accelerate the upgrade of broadband speed, strengthened the integrated development of “5G + Gigabit Broadband + Gigabit WiFi”, built a solid foundation for high-speed access for Smart Family, and further promote the uplifting of the penetration rate of Gigabit subscribers as well as subscriber value. The Company continued to enrich the supply of applications under family scenes, accelerated the construction of a smart, secure, convenient and comfortable digital home information service system, and constantly enhanced the “terminal + application + service” whole-home intelligent solutions to promote the evolution from Smart Home to Whole-home Intelligence. The Company continued to promote the platform integration and connected development of Smart Family, Smart Community and Digital Village. The Company accelerated the construction of a digitalised application platform integrating all scenes of “family-community-village-city”, providing communities and villages with leading capabilities in connecting households, communities and government, as well as abundant solutions for grassroots governance. The Company also provided integrated scene-based applications such as Video Door Access Control, Community Management and Village Governance, to establish a new scene featuring CHBG connection. Leveraging its digital capabilities and intelligent applications, the Company empowered and enhanced the quality of the modernised transformation of grassroots social governance, while supporting the digital transformation of lifestyle and social governance.

In 2022, the Company’s Wireline and Smart Family service revenues amounted to RMB118.5 billion, representing an increase of 4.4% year-on-year. The number of broadband subscribers reached 181 million, representing a net addition of 11.19 million. The penetration rate of Gigabit broadband subscribers reached 16.8%, representing a year-on-year increase of 9.1 percentage points. Broadband blended ARPU reached RMB46.3, representing a year-on-year increase of 0.9%.

Thriving development of Industrial Digitalisation, supporting “the cloud migration, the use of data and intelligence injection” for numerous walks of life

Continuously accelerating the development of the second growth curve driven by the “four-integrated” strategy, enabling the INDUSTRIAL Digitalisation business to grow rapidly and China Telecom Cloud to double its revenue

The Company firmly grasped the demand for network-based, digitalised, and smart integrated information services in the era of digital economy, and accelerated the building of the “second growth curve” driven by cloud-, AI-, security- and platform-integrated initiatives.

Continuously maintaining the rapid development of China Telecom Cloud. The Company strove to forge the source of original cloud computing technologies, and achieved breakthroughs in more than 50 key core technologies such as distributed database and cloud operating system. China Telecom Cloud 4.0 has entered the stage of full commercialisation, and its market share has continued to rise, becoming the world’s largest carrier cloud and China’s largest hybrid cloud. It has grown to rank among the top-three in China’s public cloud IaaS market and public cloud IaaS+PaaS market, while maintaining its No.1 position in the dedicated cloud market in terms of market share.

Continuously expanding deployment in emerging fields such as AI and security. In terms of AI, the Company built the industry’s first billion-parameter large-scale model for urban governance, with core algorithm capabilities covering image, voice, semantics and other fields, and launched more than 5,000 AI algorithms. In terms of security, the Company further strengthened product and service capabilities, and built a “Cloud Dam” platform with full network coverage and an integrated-security infrastructure platform, “Security Brain”. The Company continued to optimise its proprietary quantum security service platform and launched the first quantum security phone product in the industry – Quantum-encrypted Calls.

Continuously building new advantages in 5G industry applications and digital platforms. Leveraging its proprietary core capabilities such as 5G, cloud, IoT and Internet of Videos, the Company further upgraded 5G 2B businesses, accelerated the construction of a self-service operation platform for 5G customised network customers, and pushed forward the building of proprietary digital platforms capabilities. The Company also built a unified industry digital platform foundation, continued to accumulate fundamental capabilities, and further advanced the business capabilities and service level of 5G industry applications and digital platforms. The cumulative number of 5G 2B commercial projects developed by the Company reached approximately 15,000, of which the number of newly added projects in 2022 exceeded 8,000. This fully unleashed new momentum of transformation for vertical industries.

In 2022, revenue from Industrial Digitalisation of the Company amounted to RMB117.8 billion, representing a year-on-year growth of 19.7% on a comparable basis. Revenue from China Telecom Cloud reached RMB57.9 billion, representing an increase of 107.5% year-on-year. Revenue from network security services amounted to RMB4.7 billion, representing an increase of 23.5% year-on-year.

Continuously accelerating the digital transformation of products, channels, sales and marketing and services, while significantly enhancing the digital operation and service capabilities

Adhering to the service principles of “Customer First and Service Foremost”, the Company accelerated the enhancement of key capabilities such as digitalisation of products, channels, sales and marketing and services, with a focus on changes in customer demands in the digital era. The Company also further promoted business innovation and service transformation, and strove to build a service-oriented enterprise.

The Company continued to enhance its loading of products in digitalised forms, while optimising its online activation and digital operating capabilities, to empower various online and offline contact points. It continued to deepen the online product supply, business processing and online and offline integrated delivery capabilities, optimised the digital management system of sales expenses such as channels, and increased the operation efficiency and effectiveness of channels. The Company further enhanced precision marketing and service capabilities based on AI and Big Data technologies. By strengthening the application of data labels, the Company generated accurate user profiles, and optimised its full-chain digital management of customer value insight, operation and retention as well as expansion and upgrade. The Company further stepped up the application of new technologies based on data and intelligence, introduced AI digital employees, and accelerated the enhancement of service efficiency of 10000 service hotline. This created a 24/7 and all-round new intelligent service experience, facilitated the combination of traditional services with smart innovation, and promoted the continuous upgrade of service efficiency and customer perceptions.

In 2022, the service quality of the Company’s networks, products and channels further strengthened, and customer reputation continued to become more positive, while its overall customer satisfaction maintained an industry-leading position.

Continuously accelerating the construction and upgrade of digital information infrastructure, while further enhancing cloud-network integration capabilities

The Company resolutely fulfilled its responsibilities as the major force in building Cyberpower and Digital China, as well as in safeguarding network and information security. With the full implementation of its Cloudification and Digital Transformation strategy, the Company accelerated the construction of intelligent integrated digital information infrastructure that is high-speed and ubiquitous, aerial-ground in one, cloud-network integrated, intelligent and agile, green and low-carbon, and secure and controllable.

In the field of computing power, the Company further optimised the “2 + 4 + 31 + X + O” layout of its computing power and built proprietary multiple AZs capabilities of China Telecom Cloud 4.0 in central nodes of regions of Beijing-Tianjin-Hebei, Yangtze River Delta, Guangdong-Hong Kong-Macau Greater Bay Area and Chengdu-Chongqing. The number of cities covered by “One-City-One-Pool” exceeded 240, while the number of edge computing power nodes surpassing 800. The Company built the four-level AI computing power comprising of “entire network-region-edge-terminal” with nationwide coverage. The Company aggregated more than 5,000 algorithms and over 100 scene-based solutions. The Company proactively responded to the national strategy of “East-to-West Computing Resource Transfer” and stepped up deployment with a focus on 8 hub nodes. The Company has the greatest number and the most extensive distribution of IDC resources in China.

In the field of Gigabit fibre network, the Company continued to accelerate the construction of Gigabit network and built the largest Gigabit fibre network in scale, with the number of 10G PON ports exceeding 6.30 million, covering over 250 million family users in the Company’s service region.

In the field of 4G/5G network, the Company and China Unicom comprehensively deepened co-building and co-sharing. The cumulative number of 5G base stations co-built and co-shared by the two parties exceeded one million while the number of co-shared 4G stations exceeding 1.1 million, contributing key technologies in co-building and co-sharing as well as operation and management experiences to the global communications industry.

In the field of satellite communications, the Company continued to promote breakthroughs in key core technologies of the information network featuring aerial-ground in one. The Company achieved interconnection between the mobile network and the satellite network and realised multiple functions for one single card.

In the field of security, the Company continued to give full play to its role in safeguarding network and information security, formed security infrastructure capabilities covering cloud, network, edge and terminal, and completed the construction of “Cloud Dam” platform with full network coverage. The Company’s security capability pools covered more than 150 cities.

In the field of green and low-carbon, the Company fully promoted the green and low-carbon transformation of cloud-network infrastructure, and adopted measures such as customised high-performance servers to enhance computing efficiency. The Company also applied various new energy-saving technologies to enhance the energy efficiency of datacentres and telecommunications equipment rooms, and sped up the energy-saving application of AI technologies to mobile base stations and old equipment rooms, with a power saving of over 600 million kWh per year, contributing to the green and low-carbon transformation of the economy and society.

Management introduced the Company’s market-oriented talent incentive mechanism

6. FINANCIAL OVERVIEW

In 2022, adhering to the new development principles, the Company seized opportunities arising from the development of digital economy and comprehensively implemented the “Cloudification and Digital Transformation” strategy. The Company increased investment in key areas such as sci-tech innovation and Industrial Digitalisation. At the same time, the Company strengthened digital operation to reduce costs and enhance efficiency, further increased resource efficiency, and supported the long-term value creation of the Company. The Company achieved new results in high-quality development. In 2022, operating revenues were RMB481,448 million, representing an increase of 9.5% from year 202115. Service revenues16 were RMB434,928 million, representing an increase of 8.0% from year 2021. Excluding the revenue impact from the disposals of its subsidiaries in 202117, the year-on-year growth rate reached 8.1%, maintaining continuous growth for ten consecutive years. Operating expenses were RMB448,021 million, representing an increase of 9.6% from year 2021. The Company continued to enhance its profitability. Profit attributable to equity holders of the Company was RMB27,593 million, representing an increase of 6.3% from year 2021. Excluding the one-off after-tax gain from the disposals of its subsidiaries in 202118, the year-on-year growth rate reached 12.5%. Basic earnings per share were RMB0.30. EBITDA19 amounted to RMB130,359 million, representing an increase of 5.2% from year 2021. EBITDA margin20 was 30.0%.

15 In 2022, the Group acquired Beeya (Shanghai) Technology Co., Ltd.. As a business combination under common control, comparative figures of the prior year have been restated.

16 Service revenues are calculated based on operating revenues minus sales of mobile terminals, sales of wireline equipment, and other non-service revenues.

17 Service revenues for 2021 excluded Internet Finance revenue prior to the disposal of E-surfing Pay Co., Ltd. which was completed in April 2021.

18 The one-off after-tax gain from the disposals of E-surfing Pay Co., Ltd. and China Telecom Leasing Corporation Limited in 2021 was approximately RMB1,416 million.

19 EBITDA is calculated based on operating revenues minus operating expenses plus depreciation and amortisation. As the telecommunications business is a capital intensive industry, capital expenditure, the level of gearing and finance costs may have a significant impact on the net profit of companies with similar operating results. Therefore, we believe EBITDA may be helpful in analysing the operating results of a telecommunications service provider such as the Company. Although EBITDA has been widely applied in the global telecommunications industry as a benchmark to reflect operating performance, debt raising ability and liquidity, it is not regarded as a measure of operating performance and liquidity under the International Financial Reporting Standards. It also does not represent net cash from operating activities. In addition, our EBITDA may not be comparable to similar indicators provided by other companies.

20 EBITDA margin is calculated based on EBITDA divided by service revenues.

OPERATING REVENUES

In 2022, the Company leveraged its edges in cloud-network servicing capabilities, accelerated the development of Industrial Digitalisation service, further upgraded its integrated intelligent information products and services, and strengthened the new supply of digital products. As a result, its revenues continuously maintained favourable growth while its revenue structure further optimised. In 2022, operating revenues were RMB481,448 million, representing an increase of 9.5% from year 2021. Service revenues were RMB434,928 million, representing an increase of 8.0% from year 2021.

The following table sets forth a breakdown of the operating revenues for year 2022 and 2021, together with their respective rates of change:

|

For the year ended 31 December |

|||

|

(RMB million, except percentage data) |

2022 |

2021 |

Rates of change |

|

Service revenues |

434,928 |

402,828 |

8.0% |

|

Of which: Mobile communications |

191,026 |

184,158 |

3.7% |

|

Wireline and Smart Family |

118,534 |

113,522 |

4.4% |

|

Industrial Digitalisation |

117,756 |

98,945 |

19.0% |

|

Other service revenues |

7,612 |

6,203 |

22.7% |

|

Revenues from sales of goods and others |

46,520 |

36,725 |

26.7% |

|

Total operating revenues |

481,448 |

439,553 |

9.5% |

Mobile communications service revenues

In 2022, the Company continued to strengthen its 5G network coverage, optimise network quality and enhance 5G user experience to promote mobile subscribers growth and value stabilisation as well as the stable growth of fundamental businesses. In 2022, revenues from mobile communications services were RMB191,026 million, representing an increase of 3.7% over the same period of last year and accounting for 39.7% of operating revenues.

Wireline and Smart Family service revenues

In 2022, leveraging the convergence of “5G + Gigabit broadband + Gigabit WiFi”, the Company promoted the speed upgrade of broadband subscribers as well as the upgrade from Whole-home Intelligence to family DICT. The value contribution from Smart Family services continued to grow, with broadband blended ARPU maintaining favourable growth. In 2022, the Company’s Wireline and Smart Family service revenues were RMB118,534 million, representing an increase of 4.4% over the same period of last year and accounting for 24.6% of operating revenues.

Industrial Digitalisation service revenues

In 2022, the Company proactively seized the current opportunities brought by the demands from various industries in the economy and society for network-based, digitalised, and smart integrated information services. Leveraging its own resources in the whole process and whole network, the Company empowered the digital transformation of numerous walks of life and promoted “the cloud migration, the use of data and intelligence injection” for more enterprises. In 2022, the Company’s Industrial Digitalisation service revenues were RMB117,756 million, representing an increase of 19.0% over last year and accounting for 24.5% of operating revenues.

Other service revenues

In 2022, revenues from other services amounted to RMB7,612 million, representing an increase of 22.7% from year 2021, mainly due to the increase in revenues from property rental.

Revenues from sales of goods and others

In 2022, revenues from sales of goods and others amounted to RMB46,520 million, representing an increase of 26.7% from year 2021, mainly due to the rapid growth in the sales volume of mobile terminals, such as 5G mobile phones.

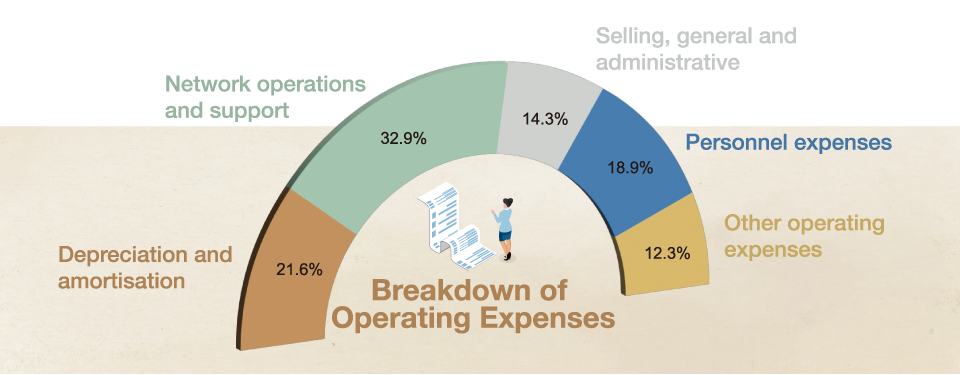

OPERATING EXPENSES

Seizing the opportunities arising from the development of digital economy, the Company increased investment in key areas such as sci-tech innovation and Industrial Digitalisation. At the same time, the Company strengthened digital operation to reduce costs and enhance efficiency, further increased resource efficiency, and supported the high-quality development and long-term value creation of the Company. In 2022, operating expenses were RMB448,021 million, representing an increase of 9.6% from year 2021. Operating expenses accounted for 93.1% of operating revenues.

The following table sets forth a breakdown of the operating expenses in 2022 and 2021 and their respective rates of change:

|

For the year ended 31 December |

|||

|

(RMB million, except percentage data) |

2022 |

2021 |

Rates of change |

|

Depreciation and amortisation |

96,932 |

92,966 |

4.3% |

|

Network operations and support |

147,589 |

133,340 |

10.7% |

|

Selling, general and administrative |

64,277 |

61,154 |

5.1% |

|

Personnel expenses |

84,772 |

76,057 |

11.5% |

|

Other operating expenses |

54,451 |

45,088 |

20.8% |

|

Total operating expenses |

448,021 |

408,605 |

9.6% |

Depreciation and amortisation

In 2022, the Company further promoted 5G co-building and co-sharing as well as 4G network co-sharing. At the same time, in order to support the construction of 5G network at scale and expand the deployment of new infrastructure such as datacentres and cloud, the Company continued its capital expenditure input. Depreciation and amortisation amounted to RMB96,932 million, representing an increase of 4.3% from year 2021 and accounting for 20.1% of operating revenues.

Network operations and support

In 2022, the Company proactively supported the rapid development of 5G, Industrial Digitalisation business and Smart Family business, and appropriately increased investment in the build-up of capabilities. At the same time, with the continuous expansion of the Company’s network, operating costs such as electricity charge and tower rental fees increased accordingly. Network operations and support expenses amounted to RMB147,589 million, representing an increase of 10.7% from year 2021 and accounting for 30.7% of operating revenues.

Selling, general and administrative

In 2022, selling, general and administrative expenses amounted to RMB64,277 million, representing an increase of 5.1% from year 2021 and accounting for 13.4% of operating revenues. The Company firmly seized the development opportunities of 5G and maintained the necessary input in marketing resources. At the same time, the Company deepened channel transformation and upgrades, accelerated the construction of a new digital marketing service channel system, and strengthened online and offline coordination. The Company also stepped up precision marketing and enhanced the efficiency of selling expenses. In 2022, selling expenses were RMB50,486 million, representing an increase of 3.9% from year 2021. The Company proactively promoted sci-tech innovation to accelerate its transformation towards a technology-oriented enterprise, with appropriate increase in R&D initiatives. In 2022, general and administrative expenses amounted to RMB13,791 million, representing an increase of 9.8% from year 2021.

Personnel expenses